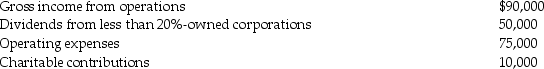

Dexter Corporation reports the following results for the current year:

In addition, Dexter has a $25,000 NOL carryover from the preceding tax year.What is Dexter's taxable income for the current year?

In addition, Dexter has a $25,000 NOL carryover from the preceding tax year.What is Dexter's taxable income for the current year?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q49: Jackson Corporation, not a dealer in securities,

Q51: On December 10,2011,Dell Corporation (a calendar-year taxpayer)accrues

Q55: Bright Corporation purchased residential real estate five

Q63: Little Corporation uses the accrual method of

Q69: Zerotech Corporation donates the following property to

Q75: For corporations, what happens to excess charitable

Q92: The following expenses are incurred by Salter

Q94: Carter Corporation reports the following results for

Q95: Bermuda Corporation reports the following results in

Q102: Exam Corporation reports taxable income of $800,000

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents