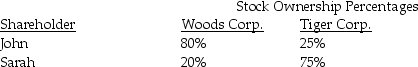

Woods and Tiger Corporations have only one class of stock outstanding, owned by the following individuals:

Are Woods and Tiger members of a brother-sister controlled group? Why or why not?

Are Woods and Tiger members of a brother-sister controlled group? Why or why not?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q68: What are start-up expenditures?

Q68: Describe the domestic production activities deduction.

Q72: What are the various levels of stock

Q76: When computing corporate taxable income, what is

Q77: What impact does an NOL carryforward have

Q92: Zeta Corporation received a $150,000 dividend from

Q102: Exam Corporation reports taxable income of $800,000

Q105: What are the four principles underlying ASC

Q108: Westwind Corporation reports the following results for

Q109: Ben and Jerry Corporations are members of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents