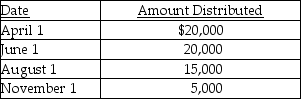

Exit Corporation has accumulated E&P of $24,000 at the beginning of the current tax year.Current E&P is $20,000.During the year, the corporation makes the following distributions to its sole shareholder who has a $22,000 basis for her stock.  The treatment of the $15,000 August 1 distribution would be

The treatment of the $15,000 August 1 distribution would be

A) $15,000 is taxable as a dividend; $5,000 from current E&P and the balance from accumulated E&P.

B) $15,000 is taxable as a dividend from accumulated E&P.

C) $4,000 is taxable as a dividend from accumulated E&P, and $11,000 is tax-free as a return of capital.

D) $5,000 is taxable as a dividend from current E&P, and $10,000 is tax-free as a return of capital.

Correct Answer:

Verified

Q4: Identify which of the following statements is

Q6: For purposes of determining current E&P, which

Q10: Crossroads Corporation distributes $60,000 to its sole

Q24: Wills Corporation, which has accumulated a current

Q26: Dixie Corporation distributes $31,000 to its sole

Q30: Corporations recognize gains and losses on the

Q41: Which of the following transactions does not

Q44: Bat Corporation distributes stock rights with a

Q50: An individual shareholder owns 3,000 shares of

Q57: Tia owns 2,000 shares of Bass Corporation

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents