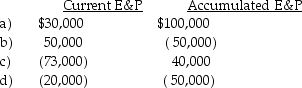

Green Corporation is a calendar-year taxpayer.All of the stock is owned by Evan.His basis for the stock is $35,000.On March 1 (of a non-leap year), Green Corporation distributes $120,000 to Evan.Determine the tax consequences of the cash distribution to Evan in each of the following independent situations:

Correct Answer:

Verified

b)$50,...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q15: How does a shareholder classify a distribution

Q35: Outline the computation of current E&P, including

Q46: Gould Corporation distributes land (a capital asset)worth

Q49: What is a constructive dividend? Under what

Q56: Strong Corporation is owned by a group

Q80: Checkers Corporation has a single class of

Q89: Dave, Erica, and Faye are all unrelated.

Q92: Payment Corporation has accumulated E&P of $19,000

Q95: Peter owns all 100 shares of Parker

Q108: What must be reported to the IRS

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents