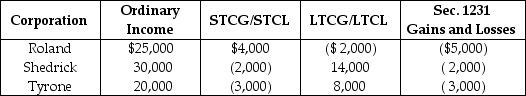

Roland, Shedrick, and Tyrone Corporations formed an affiliated group a number of years ago, which has since filed consolidated tax returns.No prior Sec 1231 losses have been reported by any group member.The group had a consolidated capital loss carryover last year.For the current year, the group reports the following results:  Which of following statements is incorrect?

Which of following statements is incorrect?

A) No Sec. 1231 recapture can occur this year.

B) The net capital gain is taxed at the regular corporate tax rates.

C) The Sec. 1231 loss is treated as an ordinary loss.

D) The net capital gain is $20,000.

Correct Answer:

Verified

Q9: Toby Corporation owns 85% of James Corporation's

Q33: Penish and Sagen Corporations have filed consolidated

Q43: Gee Corporation purchased land from an unrelated

Q56: Parent Corporation purchases a machine (a five-year

Q60: Identify which of the following statements is

Q63: P-S is an affiliated group that files

Q66: Boxcar Corporation and Sidecar Corporation, an affiliated

Q71: Identify which of the following statements is

Q83: An affiliated group elects the use of

Q85: A consolidated return's tax liability is owed

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents