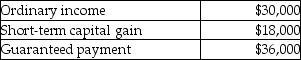

Brent is a limited partner in BC Partnership.His distributive share of partnership income and his guaranteed payment for the year are as follows:  What is his self-employment income?

What is his self-employment income?

A) $84,000

B) $66,000

C) $48,000

D) $36,000

Correct Answer:

Verified

Q14: Dan purchases a 25% interest in the

Q20: Doug purchases a 20% interest in the

Q23: Jane contributes land with an FMV of

Q63: Nicholas, a 40% partner in Nedeau Partnership,

Q70: Yee manages Huang real estate, a partnership

Q82: David purchased a 10% capital and profits

Q89: Identify which of the following statements is

Q97: Jangyoun sells investment land having a $30,000

Q103: Henry has a 30% interest in the

Q106: In January of this year, Arkeva, a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents