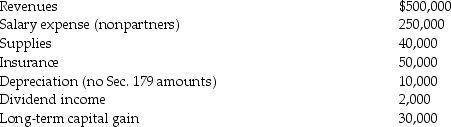

AT Pet Spa is a partnership owned equally by Travis and Ashley.The partnership had the following revenues and expenses this year.Which of the following items are separately stated? Nonseparately stated? What is each partner's distributive share of ordinary income?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q7: Explain the difference between partnership distributions and

Q26: Bob contributes cash of $40,000 and Carol

Q27: Kay and Larry each contribute property to

Q38: Jane contributes land with an FMV of

Q82: The WE Partnership reports the following items

Q85: The XYZ Partnership is held by ten

Q88: The Troika Partnership has an ordinary loss

Q104: When determining the guaranteed payment, which of

Q114: In January, Daryl and Louis form a

Q116: Identify which of the following statements is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents