Tenika has a $10,000 basis in her interest in the TF Partnership and no remaining precontribution gain immediately before receiving a current distribution that consisted of $4,000 in money, plastic tubes held in inventory with a $3,000 basis to the partnership and an FMV of $3,375, and drip irrigation pipe held as inventory with a $6,000 basis to the partnership and an FMV of $5,000.What is Tenika's basis for the plastic tubes and drip irrigation pipe?

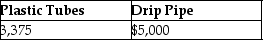

A)

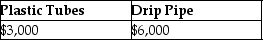

B)

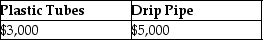

C)

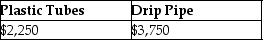

D)

Correct Answer:

Verified

Q3: Bart has a partnership interest with a

Q14: Tenika has a $10,000 basis in her

Q18: The total bases of all distributed property

Q21: The AB Partnership has a machine with

Q24: The ABC Partnership owns the following assets

Q25: The XYZ Partnership owns the following assets

Q28: What is the definition of "substantially appreciated

Q30: The definition of "unrealized receivable" does not

Q34: For purposes of Sec. 751, inventory includes

Q44: Identify which of the following statements is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents