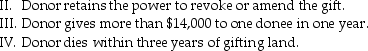

Which of the following circumstances would cause the gifted property to be included in the donor's gross estate? I.Donor retains a life estate in the gift property.

A) I, II and III

B) I, II

C) II, IV

D) III, IV

Correct Answer:

Verified

Q2: In 2002, Gert made a $5,000,000 taxable

Q50: Melissa transferred $650,000 in trust in 2006:

Q81: The payment date for estate taxes may

Q83: Yee made $3 million of taxable gifts

Q87: Identify which of the following statements is

Q88: The GSTT's (generation-skipping transfer tax)purpose is

A)to impose

Q93: The maximum amount of the stock redemption

Q95: One of the major problems facing executors

Q96: Sasha gives $1,000,000 to her granddaughter. Sasha

Q100: A qualified disclaimer is a valuable estate

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents