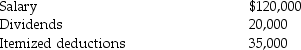

Latka Novatny gave you the following information to use in the preparation of his current year's tax return:

In addition, he received $40,000 from a relative for whom he had worked previously.You have researched whether the $40,000 should be classified as a gift or compensation and are confident that substantial authority exists for classifying it as a gift.What tax compliance issues should you consider in deciding whether to report or exclude the $40,000?

In addition, he received $40,000 from a relative for whom he had worked previously.You have researched whether the $40,000 should be classified as a gift or compensation and are confident that substantial authority exists for classifying it as a gift.What tax compliance issues should you consider in deciding whether to report or exclude the $40,000?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q25: Explain one of the two exceptions to

Q54: Jeff's tax liability for last year was

Q63: The IRS audited the tax returns of

Q67: You are preparing the tax return for

Q73: Richard recently won a popular television reality

Q74: How does a taxpayer determine if "substantial

Q77: Pablo, a bachelor, owes $80,000 of additional

Q80: The IRS audits Kiara's current-year individual return

Q88: For innocent spouse relief to apply, five

Q88: Kristina and Victor filed a joint return

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents