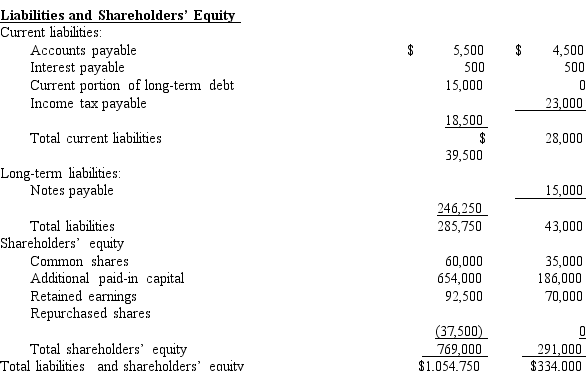

The balance sheet taken from the company's Year 3 is provided below:

-Refer to Rhodes Bakery.Calculate the following short-term liquidity ratios for Year 3 and Year 2: current ratio,quick ratio,cash ratio,and operating cash flow ratio.Cash flows from operations were $75,500 and $50,500 for Year 3 and Year 2,respectively.Round your answers to two decimal places.Comment on the company's short-term liquidity.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q121: Ready Mix USA

Three recent income statements are

Q127: Ready Mix USA

Three recent income statements are

Q177: Information from the financial statements is

Q178: When calculating the return on common equity

Q179: Which of the following is indicated by

Q180: A financial analyst wants to measure the

Q181: The current assets section of the

Q183: Refer to Rhodes Bakery.Calculate the following

Q184: The current assets section of the

Q186: Use the following selected financial information

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents