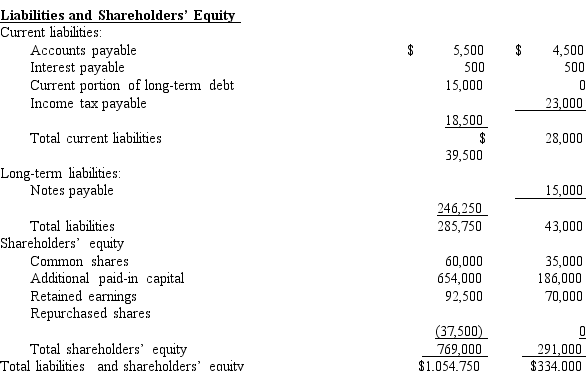

The balance sheet taken from the company's Year 3 is provided below:

-Refer to Rhodes Bakery.Calculate the following debt management ratios for Year 3 and Year 2: times interest earned ratio,long-term debt-to-equity ratio,debt-to-equity ratio,long-term debt-to-assets ratio,and debt-to-assets ratio.Income from operations was $65,000 and $49,000 and interest expense was $26,000 and $1,750 for 2015 and 2014,respectively.Round your answers to two decimal places.Comment on the company's debt management.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q189: Use the following selected financial information to

Q190: Below is some information taken from

Q191: DuPont analysis recognizes that the return on

Q192: Refer to Rhodes Bakery.Calculate the following profitability

Q193: Refer to Rhodes Bakery.Perform DuPont Analysis

Q195: With regard to its relationship to dividends

Q196: The following information is available for

Q197: The following information is available for

Q198: Use the selected financial information provided

Q199: Which of the following is NOT a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents