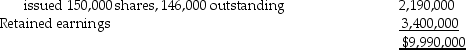

Cough FX Limited reports the following shareholders' equity as of December 31,2017:

Preferred shares,$5.00,authorized 100,000 shares,

Common shares,authorized 200,000 shares,

Common shares,authorized 200,000 shares,

Determine the following:

Determine the following:

a.What was the average issue price per common share?

b.What was the average issue price per preferred share?

c.Assume the board of directors declares dividends totaling $1,850,000 to the shareholders.The preferred shares are cumulative,and no dividends were declared last year.Calculate the amount per share each class of shares will receive.

d.Assume the board of directors authorizes a 2-for-1 split on the common shares.Calculate the number of shares outstanding after the split and the book value of Both classes of shares.

e.Assume the board of directors authorizes a 15% stock dividend on the common shares after the stock split.The current selling price of the common shares is $9.Prepare the journal entry to distribute the stock dividend.

Correct Answer:

Verified

...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q67: Health & Wellness Corporation has had 7,500

Q68: Following is the shareholders' equity section of

Q69: Following is the shareholders' equity section of

Q70: A stock dividend will:

A) reduce total assets

B)

Q71: The entry to record the declaration of

Q72: Following is the shareholders' equity section of

Q73: JetNew has the follow share outstanding since

Q74: Prevage Corporation has 10,000 shares of $10

Q75: Which of the following statements regarding stock

Q76: Following is the shareholders' equity section of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents