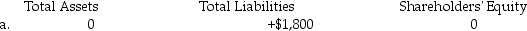

Following is a list of errors made during the posting process.Indicate the exact dollar impact each error would have on total assets,total liabilities,and shareholders' equity.Complete the chart below by using (+)to indicate overstated,(-)to indicate understated,and (0)to indicate no effect.Transaction (a)is completed as an example.

a.A $200 credit to the Accounts Payable account was posted as $2,000.

b.A $50 debit to Cash was never posted.

c.A $550 credit to the Revenue account was credited to the Accounts Receivable account.

d.A $45,000 debit to the Land account was debited to an expense account.

e.A $200 payment on an account payable was credited to Accounts Receivable instead of Cash.

f.A $350 debit to the Dividends account was posted as $530.

b.

b.

c.

d.

e.

f.

Correct Answer:

Verified

Q83: A journal is a record of financial

Q111: The entry to record the purchase

Q112: Prepare journal entries in good form for

Q113: Prepare journal entries in good form for

Q114: Describe the journalizing process including its steps.

Q117: Where is information for each account stored?

Q118: The entry to record an owner

Q119: The entry to record the payment

Q121: In the journal you will find the

Q121: The normal balance of an expense account

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents