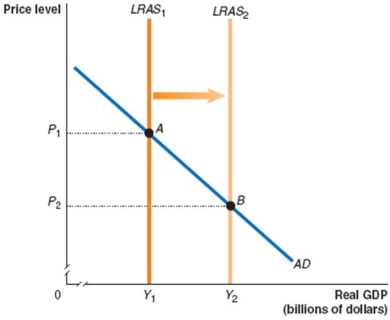

Refer to Figure 18.6 for the following questions.

Figure 18.6

-Suppose the federal government reduces income taxes.Assume that the movement from A to B in Figure 18.6 represents normal growth in the economy before the tax change.If the tax change is not effective and labour supply and savings do not increase because of the tax change,then the tax change will __________.

A) decrease the price level below P2

B) increase output above Y2

C) not change the price level

D) shift LRAS2 to the right

Correct Answer:

Verified

Q125: What is the structural budget deficit or

Q126: The _ the tax wedge, the smaller

Q128: Show the impact of tax reduction and

Q131: Explain how lowered taxes on capital gains

Q134: During an 'economic contraction', why is it

Q136: Is government debt bad for the economy?

_

_

Q137: Show the effects of tax reduction and

Q138: If tax reduction and simplification are effective,

Q140: As the tax wedge between pre-tax and

Q279: Tax reduction and simplification should _ long-run

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents