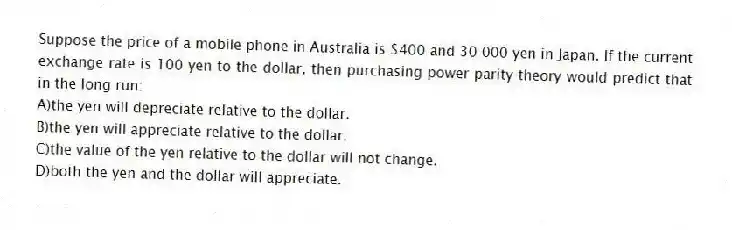

Suppose the price of a mobile phone in Australia is $400 and 30 000 yen in Japan. If the current exchange rate is 100 yen to the dollar, then purchasing power parity theory would predict that in the long run:

A) the yen will depreciate relative to the dollar.

B) the yen will appreciate relative to the dollar.

C) the value of the yen relative to the dollar will not change.

D) both the yen and the dollar will appreciate.

Correct Answer:

Verified

Q41: Soon after the Australia dollar was floated,

Q42: Describe how the 'Bretton Woods System' operated.

_

_

Q43: What is a 'gold standard'? What kind

Q45: Explain the difference between a 'floating exchange

Q47: The 'purchasing power parity theory' of exchange

Q48: Exchange rates will equalise purchasing power parity

Q49: The 'theory of purchasing power parity' implies

Q50: The trade weighted index (TWI)is a measure

Q51: 'Purchasing power parity' is the theory that

Q135: All of the following explain why purchasing

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents