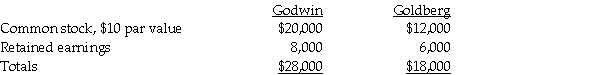

At December 31,2013,the stockholders' equity of Godwin Corporation and its 80%-owned subsidiary,Goldberg Corporation,are as follows:

Godwin's Investment in Goldberg is equal to 80 percent of Goldberg's book value.Goldberg Corporation issued 225 additional shares of common stock directly to Godwin on January 1,2014 at $28 per share.

Required:

1.Compute the balance in Godwin's Investment in Goldberg account on January 1,2014 after the new investment is recorded.

2.Determine the increase or decrease in goodwill from Godwin's new investment in the 225 Goldberg shares.Use four decimal places for the ownership percentage.Assume the fair value and book value of Goldberg's assets and liabilities are equal.

Correct Answer:

Verified

Q22: On September 1,2013,Nelson Corporation acquired a 90%

Q23: At December 31,2014 year-end,Arnold Corporation's investment in

Q25: On December 31,2013,Dixie Corporation has the following

Q28: At December 31,2013,the stockholders' equity of Pearson

Q28: At December 31,2015 year-end,Lapwing Corporation's investment in

Q29: At December 31,2013,the stockholders' equity of Gost

Q30: On January 1,2014,Fly Corporation held a 60%

Q31: On December 31,2013,Lorna Corporation has the following

Q32: Olson Corporation paid $62,000 to acquire 100%

Q34: On December 31,2013,Potter Corporation has the following

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents