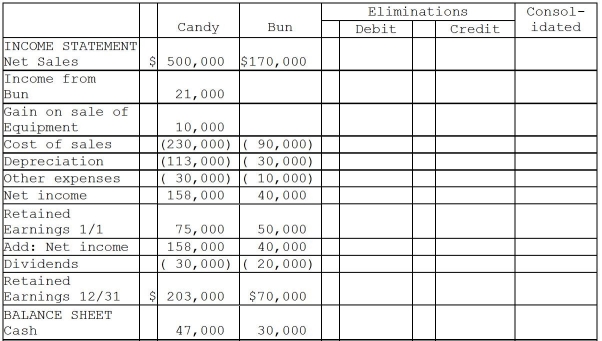

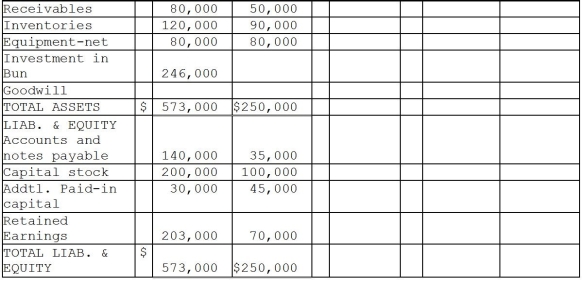

Candy Corporation paid $240,000 on April 1,2013 for all of the common stock of Bun Corporation in a business acquisition.On January 1,2013,Bun's stockholders' equity was equal to $195,000.Bun's first quarter 2013 net income was $10,000 and first quarter 2013 dividends were $5,000.In 2013,preacquisition sales were $32,500 and preacquisition cost of sales was $22,500.(There were no other preacquisition expenses in 2013 . )Dividends are paid quarterly on March 31,June 30,September 30 and December 31.Any excess cost over book value acquired is allocated to goodwill.

Additional information:

1.Candy sold equipment with a 5-year remaining useful life to Bun on July 1,2013 for a gain of $10,000.Salvage value of the equipment is zero and both companies use the straight-line depreciation method.

2.Bun's accounts payable balance at December 31 includes $5,000 due to Candy from the sale of equipment.

3.Candy accounts for its investment in Bun using the equity method.

Required:

Complete the working papers to consolidate the financial statements of Candy and Bun Corporations for the year ending December 31,2013.

Correct Answer:

Verified

Q18: Anthony Company declared and paid $20,000 of

Q19: Consider a sale of stock by a

Q20: Use the following information to answer the

Q21: On December 31,2013,Pat Corporation has the following

Q22: Justice Corporation paid $40,000 cash for an

Q22: On September 1,2013,Nelson Corporation acquired a 90%

Q24: On December 31,2013,Maria Corporation has the following

Q25: On December 31,2013,Dixie Corporation has the following

Q28: At December 31,2015 year-end,Lapwing Corporation's investment in

Q28: At December 31,2013,the stockholders' equity of Pearson

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents