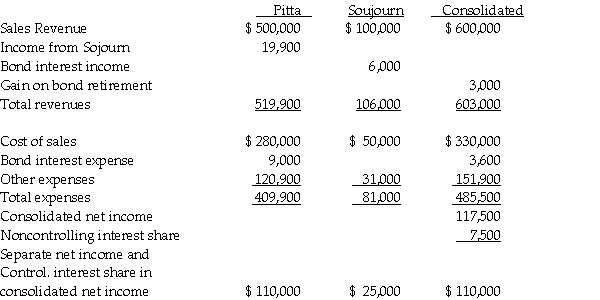

Separate company and consolidated income statements for Pitta and Sojourn Corporations for the year ended December 31,2013 are summarized as follows:

The interest income and expense eliminations relate to a $100,000,9% bond issue that was issued at par value and matures on January 1,2018.On January 2,2013,a portion of the bonds was purchased and constructively retired.

Required: Answer the following questions.

1.Which company is the issuing affiliate of the bonds payable?

2.What is the gain or loss from the constructive retirement of the bonds payable that is reported on the consolidated income statement for 2013?

3.What portion of the bonds payable is held by nonaffiliates at December 31,2013?

4.Is Sojourn a wholly-owned subsidiary? If not,what percentage does Pitta own?

5.Does the purchasing affiliate use straight-line or effective interest amortization?

6.Explain the calculation of Pitta's $19,900 income from Sojourn.

Correct Answer:

Verified

2.Effe...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q21: Platts Incorporated purchased 80% of Scarab Company

Q23: Paleo Corporation holds 80% of the capital

Q24: Pachelor Corporation owns 70% of the outstanding

Q26: Phauna paid $120,000 for its 80% interest

Q27: Popcorn Corporation owns 90% of the outstanding

Q28: Padma Corporation owns 70% of the outstanding

Q31: Sabu is a 65%-owned subsidiary of Peerless.On

Q32: Pongo Company has $2,000,000 of 6% bonds

Q35: Parkview Holdings owns 70% of Skyline Corporation.On

Q37: Pare Corporation owns 65% of the outstanding

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents