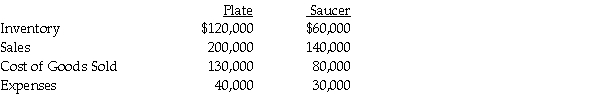

Presented below are several figures reported for Plate Corporation and Saucer Industries as of December 31,2014.Plate has owned 70% of Saucer for the past five years,and at the time of purchase,the book value of Saucer's assets and liabilities equaled the fair value.The cost of the 70% investment was equal to 70% of the book value of Saucer's net assets.At the time of purchase,the fair values and book values of Saucer's assets and liabilities were equal.

In 2013,Saucer sold inventory to Plate which had cost $40,000 for $60,000.25% of this inventory remained on hand at December 31,2013,but was sold in 2014.In 2014,Saucer sold inventory to Plate which had cost $30,000 for $45,000.40% of this inventory remained unsold at December 31,2014.

Required: Calculate following balances at December 31,2014.

a.Consolidated Sales

b.Consolidated Cost of goods sold

c.Consolidated Expenses

d.Noncontrolling interest share of Saucer's net income

e.Consolidated Inventory

Correct Answer:

Verified

Q29: On January 1,2014,Paar Incorporated paid $38,500 for

Q30: Proman Manufacturing owns a 90% interest in

Q30: Psalm Enterprises owns 90% of the outstanding

Q31: Penguin Corporation acquired a 60% interest in

Q32: Peel Corporation acquired a 80% interest in

Q33: Plover Corporation acquired 80% of Sink Inc.equity

Q35: Pittle Corporation acquired a 80% interest in

Q36: Pexo Industries purchases the majority of their

Q37: Pastern Industries has an 80% ownership stake

Q39: Preen Corporation acquired a 60% interest in

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents