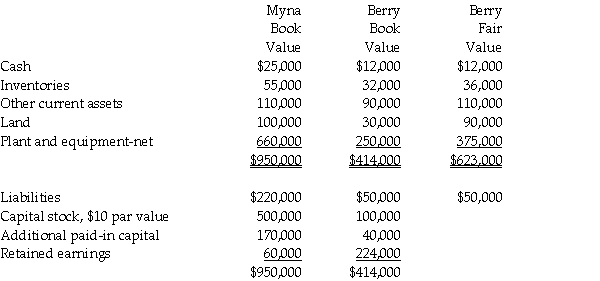

On January 1,2014,Myna Corporation issued 10,000 shares of its own $10 par value common stock for 9,000 shares of the outstanding stock of Berry Corporation in an acquisition.Myna common stock at January 1,2014 was selling at $70 per share.Just before the business combination,balance sheet information of the two corporations was as follows:

Required:

1.Prepare the journal entry on Myna Corporation's books to account for the investment in Berry Company.

2.Prepare a consolidated balance sheet for Myna Corporation and Subsidiary immediately after the business combination.

Correct Answer:

Verified

Q25: Pool Industries paid $540,000 to purchase 75%

Q26: Pamula Corporation paid $279,000 for 90% of

Q27: Polaris Incorporated purchased 80% of The Solar

Q28: On January 1,2014,Parry Incorporated paid $72,000 cash

Q29: On January 2,2014,Power Incorporated paid $630,000 for

Q31: On July 1,2014,Piper Corporation issued 23,000 shares

Q32: Passcode Incorporated acquired 90% of Safe Systems

Q33: Petra Corporation paid $500,000 for 80% of

Q34: Pool Industries paid $540,000 to purchase 75%

Q35: Park Corporation paid $180,000 for a 75%

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents