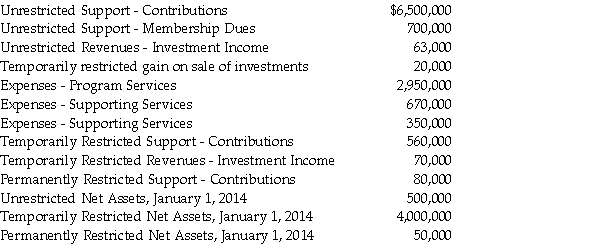

The following information was taken from the accounts and records of the Community Chest Foundation,a private,not-for-profit VHWO organization.All balances are as of December 31,2014,unless otherwise noted.

The unrestricted support from contributions was received in cash during the year.The expenses included $980,000 paid from temporarily-restricted cash donations.

Required:

Prepare Community Chest's Statement of Activities for the year ended December 31,2014.

Correct Answer:

Verified

Q5: A gift-in-kind,for which the not-for-profit entity has

Q12: On January 1,2011,a Voluntary Health and Welfare

Q15: Which of the following is not true?

A)A

Q16: Under GAAP,for nonprofit,nongovernmental entities,an unconditional transfer of

Q17: For a Voluntary Health and Welfare Organization,what

Q25: A private,not-for-profit university received donations of $800,000

Q26: Wilhelman University,a not-for-profit,nongovernmental university,had the following transactions

Q32: General Hospital is a private,not-for-profit hospital.The following

Q37: Albatross University,a not-for-profit,nongovernmental university,had the following transactions

Q38: Childrens Hospital is a private,not-for-profit hospital.The following

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents