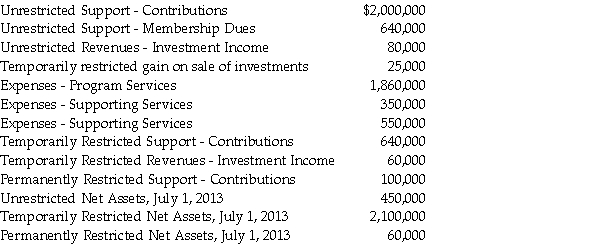

The following information was taken from the accounts and records of the Helping Hands Foundation,a private,not-for-profit organization classified as a VHWO.All balances are as of June 30,2014,unless otherwise noted.

The unrestricted support from contributions was received in cash during the year.The expenses included $1,350,000 paid from temporarily-restricted cash donations.

Required:

Prepare Helping Hands' Statement of Activities for the fiscal year ended June 30,2014.

Correct Answer:

Verified

Q21: Marshfield Hospital is a private,not-for-profit hospital.The following

Q24: Coats for Kids is a private,not-for-profit organization

Q27: Will Wealth made three charitable donations in

Q28: Carousel Clothes is a voluntary health and

Q30: Prepare journal entries to record the following

Q34: A private,not-for-profit university received donations of $1,000,000

Q34: The Trasque Hospital is a nongovernmental,not-for-profit hospital.During

Q35: Southtown Community Hospital (SCH)shows the following balances

Q36: The following information is available about the

Q40: Record the following transactions for Porter Hospital,a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents