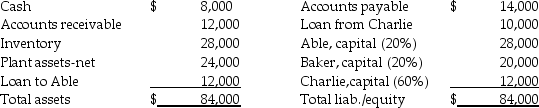

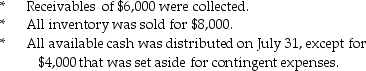

The percentages shown are the residual profit and loss sharing ratios.The partners dissolved the partnership on July 1,2014,and began the liquidation process.During July the following events occurred:

The percentages shown are the residual profit and loss sharing ratios.The partners dissolved the partnership on July 1,2014,and began the liquidation process.During July the following events occurred:

-The cash available for distribution to the partners on July 31,2014 is

A) $ 4,000.

B) $ 8,000.

C) $14,000.

D) $22,000.

Correct Answer:

Verified

Q3: How much cash would Baker receive from

Q4: Which of the following procedures is acceptable

Q5: Q6: In partnership liquidations,what are safe payments? Q7: What is the proper disposition of a Q9: A simple partnership liquidation requires Q10: Que,Rae,and Sye are in the process of![]()

A)The amounts

A)periodic payments to

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents