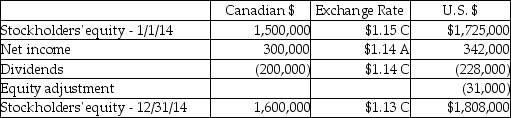

On January 1,2014,Placid Corporation acquired a 40% interest in Superior Industries,a Canadian Corporation,for $811,900 when Superior's stockholders' equity consisted of 1,000,000 Canadian dollars (C$)capital stock and C$500,000 retained earnings.Superior's functional currency is the Canadian dollar and the books are kept in the same currency.The exchange rate at the time of the purchase was $1.15 per Canadian dollar.Any excess allocated to patents is to be amortized over 10 years.A summary of changes in the stockholders' equity of Superior during 2014 and related exchange rates follows:

Required:

Determine the following:

1.Fair value of the patent from Placid's investment in Superior on January 1,2014 in U.S.dollars

2.Patent amortization for 2014 in U.S.dollars

3.Unamortized patent at December 31,2014 in U.S.dollars

4.Equity adjustment from the patent in U.S.dollars

5.Income from Superior for 2014 in U.S.dollars

6.Investment in Superior balance at December 31,2014 in U.S.dollars

Correct Answer:

Verified

Q23: For each of the 12 accounts listed

Q24: Puddle Incorporated purchased an 80% interest in

Q25: On January 1,2014,Paste Unlimited,a U.S.company,acquired 100% of

Q26: On January 1,2014,Pilgrim Corporation,a U.S.firm,acquired ownership of

Q27: Note to Instructor: This exam item is

Q29: Par Industries,a U.S.Corporation,purchased Slice Company of New

Q30: Plate Corporation,a US company,acquired ownership of Saucer

Q31: On January 1,2014,Psalm Corporation purchased all the

Q32: Plane Corporation,a U.S.company,owns 100% of Shipp Corporation,a

Q33: Note to Instructor: This exam item is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents