On November 1,2013,Stateside Company (a U.S.manufacturer)sold an airplane for 1 million New Zealand dollars (NZ$)to New Zealand company Aukland Corporation.Stateside will receive payment on January 30,2014 in New Zealand dollars.In order to hedge the accounts receivable position,Stateside entered into a 90-day forward contract to sell 1 million New Zealand dollars on January 30,2014.On November 1,2013,the 90-day forward rate is US$0.73 per New Zealand dollar.The forward contract will be settled net.Account for the hedge as a fair value hedge.Ignore the time value of money.

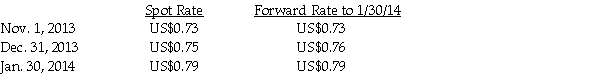

The relevant exchange rates per New Zealand dollar:

Required:

Record the journal entries that Stateside would need to prepare at November 1,2013,December 31,2013 and January 30,2014.

December 31,2013 is the fiscal year end.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q28: On November 1,2014,Moddel Company (a U.S.corporation)entered into

Q29: On November 1,2013,Ironside Company (a U.S.manufacturer)sold an

Q31: On November 1,2013,Athom Corporation purchased 5,000 television

Q32: Ferb Company is a U.S.-based importer of

Q32: On January 1,2014,Bambi borrowed $500,000 from Lonni.The

Q34: Onoly Corporation (a U.S.manufacturer)sold parts to its

Q35: On November 1,2014,Portsmith Corporation,a calendar-year U.S.corporation,invested in

Q37: On November 1,2013,Mayberry Corporation,a U.S.corporation,purchased from Cantata

Q37: Wild West,Incorporated (a U.S.corporation)sold inventory to a

Q40: On December 18,2014,Wabbit Corporation (a U.S.Corporation)has a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents