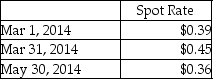

On March 1,2014,Amber Company sold goods to a foreign customer at a price of 50,000 foreign currency units.The customer will pay in three months.At the time of the sale,Amber paid $2,000 to acquire an option to sell 50,000 foreign currency units in three months at the strike price of $0.39.On May 30,2014,the customer sent in 50,000 foreign currency units.Quarterly financial reports are prepared on March 31.Ignore the time value of money.Relevant exchange rates are as follows:

Required:

Prepare the journal entries required for these transactions,if the foreign currency option is designated as a fair value hedge.

Correct Answer:

Verified

Q4: When preparing their year-end financial statements,the Warner

Q19: Cirtus Corporation,a U.S.corporation,placed an order for inventory

Q21: Astrotuff Company is planning to purchase 200,000

Q22: On December 15,2014,Electronix Company purchased inventory from

Q23: Slickton Corporation,a U.S.holding company,enters into a forward

Q23: On June 1,2014,Dapple Industries purchases an option

Q26: Ivan has 14,000 barrels of oil that

Q27: On November 1,2014,Ross Corporation,a calendar-year U.S.corporation,invested in

Q28: On November 1,2014,Moddel Company (a U.S.corporation)entered into

Q29: On November 1,2013,Ironside Company (a U.S.manufacturer)sold an

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents