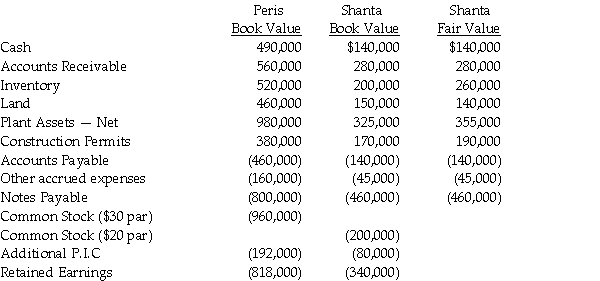

On December 31,2013,Peris Company acquired Shanta Company's outstanding stock by paying $400,000 cash and issuing 10,000 shares of its own $30 par value common stock,when the market price was $32 per share.Peris paid legal and accounting fees amounting to $35,000 in addition to stock issuance costs of $8,000.Shanta is dissolved on the date of the acquisition.Balance sheet information for Peris and Shanta immediately preceding the acquisition is shown below,including fair values for Shanta's assets and liabilities.

Required: Determine the consolidated balances which Peris would present on their consolidated balance sheet for the following accounts.

Cash

Inventory

Construction Permits

Goodwill

Notes Payable

Common Stock

Additional Paid in Capital

Retained Earnings

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q6: Use the following information to answer

Q9: Historically,much of the controversy concerning accounting requirements

Q16: Which of the following methods does the

Q17: In reference to the FASB disclosure requirements

Q18: According to FASB Statement 141R,which one of

Q22: On June 30,2013,Stampol Company ceased operations and

Q23: On January 2,2013,Pilates Inc.paid $900,000 for all

Q24: Pali Corporation exchanges 200,000 shares of newly

Q25: Saveed Corporation purchased the net assets of

Q26: Bigga Corporation purchased the net assets of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents