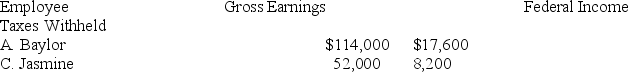

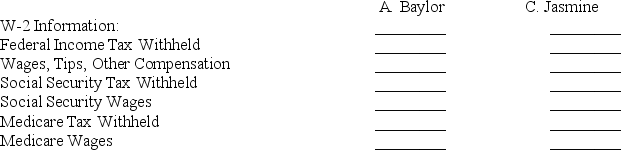

A company's employer payroll tax rates are 0.6% for federal unemployment taxes,5.4% for state unemployment taxes,6.2% for FICA social security taxes on earnings up to $118,500,and 1.45% for FICA Medicare taxes on all earnings.Compute the W-2 Wage and Tax Statement information required below for the following employees:

Correct Answer:

Verified

Q107: A company's payroll for the week ended

Q127: General Co.entered into the following transactions involving

Q182: Drake Company pays its employees for two

Q184: Early Co. offers its employees a bonus

Q192: Sparks Company entered into the following transactions

Q193: Richardson Fields receives $31,680 cash in advance

Q194: Times interest earned is computed by dividing

Q197: _are amounts received in advance from

Q202: Vacation benefits are a type of

Q233: Deacon Company provides you with following

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents