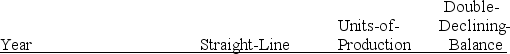

A machine costing $450,000 with a 4-year life and an estimated salvage value of $30,000 is installed by Peters Company on January 1.The company estimates the machine will produce 1,050,000 units of product during its life.It actually produces the following units for the first 2 years: Year 1,260,000; Year 2,275,000.Enter the depreciation amounts for years 1 and 2 in the table below for each depreciation method.Show calculation of amounts below the table.

Year 1

Year 2

Correct Answer:

Verified

\text { Ye ...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q142: A company purchased store equipment for $4,300

Q143: On July 1 of the current year,Glover

Q224: The depreciation method that charges a varying

Q228: A company exchanged an old automobile for

Q232: The insufficient capacity of a company's plant

Q233: The depreciation method that recognizes equal amounts

Q235: The federal income tax rules for depreciating

Q236: Westport Company reports the following in millions:

Q242: Revenue expenditures to keep an asset in

Q243: Additional costs of plant assets that provide

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents