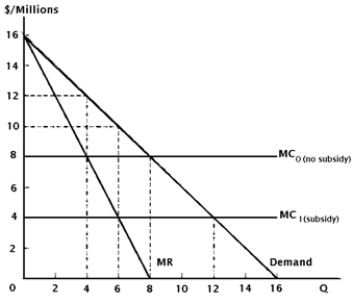

Assume Boeing Inc. (of the United States) and Airbus Industries (of Europe) rival for monopoly profits in the Canadian aircraft market. Suppose the two firms face identical cost and demand conditions, as seen in Figure 6.1.

Figure 6.1. Strategic Trade Policy: Boeing versus Airbus

-Consider Figure 6.1.At the monopoly price as established by Boeing, Canadian consumers realize $______________ of consumer surplus from the availability of aircraft.

A) $4 million

B) $8 million

C) $12 million

D) $16 million

Correct Answer:

Verified

Q18: The Export-Import Bank of the United States

Q19: The high point of U.S.protection culminated with

Q20: The Smoot-Hawley Tariff Act of 1930 has

Q21: The World Trade Organization provides for all

Q22: Countervailing duties may be imposed

A) in response

Q24: The Uruguay Round of trade negotiations lowered

A)

Q25: Which international organization stipulates procedures for the

Q26: In 1980, the United States announced an

Q27: Export embargoes induce greater losses in consumer

Q28: In U.S.trade law, which measure permits the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents