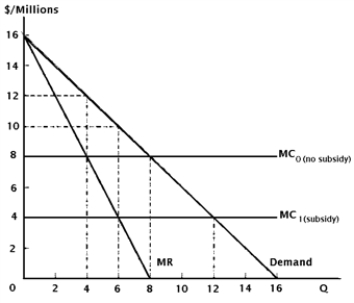

Assume Boeing Inc.(of the United States) and Airbus Industrie (of Europe) rival for monopoly profits in the Canadian aircraft market.Suppose the two firms face identical cost and demand conditions,as seen in Figure 6.1.

Figure 6.1.Strategic Trade Policy: Boeing versus Airbus

-Consider Figure 6.1.For Europe as a whole (Airbus and European taxpayers) ,the subsidy leads to a (an) increase/decrease in net revenues of $____.

A) Increase of $12 million

B) Increase of $16 million

C) Decrease of $12 million

D) Decrease of $16 million

Correct Answer:

Verified

Q47: Figure 6.2 illustrates the calculator market for

Q53: Figure 6.3 represents the Iraqi computer market.Assume

Q55: Figure 6.3 represents the Iraqi computer market.Assume

Q56: Assume Boeing Inc.(of the United States) and

Q57: Economic sanctions are most effective in causing

Q59: The implicit industrial policies of the U.S.government

Q60: Figure 6.3 represents the Iraqi computer market.Assume

Q62: Figure 6.4Japanese Market for Jetliners

Q112: The high point of U.S.protectionism occurred with

Q125: The Uruguay Round of trade negotiations resulted

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents