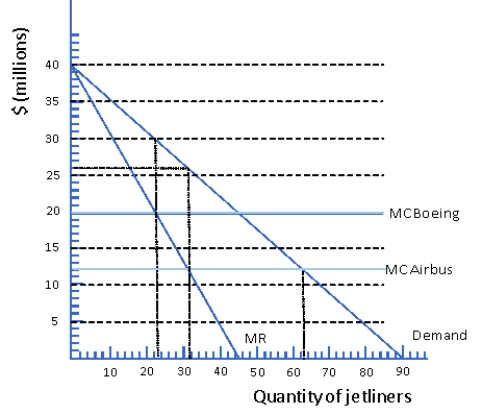

Figure 6.5 Japanese Market for Jetliners

-Consider the Japanese market for jetliners as depicted in Figure 6.5.Suppose lone producer of jetliners in the world is Boeing and Boeing faces a constant marginal cost of $20 million per jetliner but now a European manufacturer,Airbus,begins production.Airbus faces the same marginal cost as Boeing but the European government provides Airbus with a subsidy of $8 million per jetliner produced.As a result of the competition,Boeing leaves the Japanese market leaving Airbus as a monopoly.As a result of the entery of the subsidized producer what will happen to the consumer surplus gained by Japanese airlines from buying jetliners?

A) decrease by $109 million

B) nothing

C) increase by $50 million

D) increase by $109 million

Correct Answer:

Verified

Q71: According to the Reciprocal Trade Agreements Act

Q72: According to the normal-trade-relations (most-favored-nation) principle,if the

Q73: Industrial policies

A) Require formal explicit efforts by

Q76: The United States

A) Has been a heavy

Q78: U.S.tariffs on imports from countries issued normal-trade-relations

Q104: It is generally agreed that the Smoot-Hawley

Q105: With the passage of the Smoot-Hawley Act

Q111: Proponents of the Smoot-Hawley Act of 1930

Q130: According to the General Agreement on Tariffs

Q139: Members of the General Agreement on Tariffs

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents