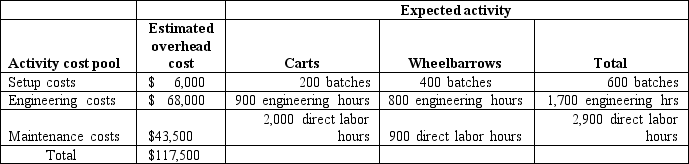

Vittoria Corporation manufactures two products-Carts and Wheelbarrows.The annual production and sales of Carts is 2,000 units,while 1,800 units of Wheelbarrows are produced and sold.The company has traditionally used direct labor hours to allocate its overhead to products.Carts require 1.0 direct labor hours per unit,while Wheelbarrows require 0.5 direct labor hours per unit.The total estimated overhead for the period is $117,500.The company is looking at the possibility of changing to an activity-based costing system for its products.If the company used an activity-based costing system,it would have the following three activity cost pools:

-The predetermined overhead allocation rate using the traditional costing system would be closest to:

A) $ 40.52 per direct labor hour.

B) $ 130.56 per direct labor hour.

C) $ 58.75 per direct labor hour.

D) $ 30.92 per direct labor hour.

Correct Answer:

Verified

Q103: Vittoria Corporation manufactures two products-Carts and

Q104: Silver Company manufactures several different

Q105: Louis Corporation,which uses an activity-based

Q106: Haas Corporation,a manufacturer of a

Q107: Kepple Manufacturing currently uses a

Q109: Heese Corporation manufactures two products-Tricycles

Q110: Franklin Corporation manufactures a wide

Q111: Kepple Manufacturing currently uses a

Q112: Moylan & Bolognese,Attorneys at Law,provide

Q113: Vittoria Corporation manufactures two products-Carts and

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents