Charms Inc.,a merchandising company,has an account receivable for $125 which it has now deemed uncollectible.The company uses the direct write-off method.Which of the following entries is required to record the write-off?

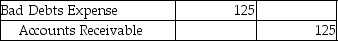

A)

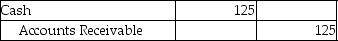

B)

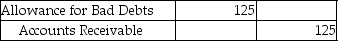

C)

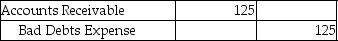

D)

Correct Answer:

Verified

Q32: Which of the following is a disadvantage

Q34: Clothesall Inc.,a readymade garment seller,accepts payment through

Q34: Give the journal entry to record an

Q36: Clothesall Inc.,a readymade garment seller,accepts payment through

Q37: The following information is from the records

Q38: On January 1,Davidson Services has the following

Q53: Which of the following statements is true

Q53: Under the direct write-off method,the entry to

Q71: The direct write-off method for uncollectible accounts

Q77: The direct write-off method is only acceptable

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents