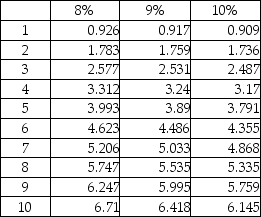

A company is considering an iron ore extraction project that requires an initial investment of $500,000 and will yield annual cash flows of $150,000 for 4 years.The company's hurdle rate is 9%.What is the NPV of the project?

A) positive $14,000

B) negative $100,000

C) positive $100,000

D) negative $14,000

Correct Answer:

Verified

Q82: Compound interest used in discounted cash flow

Q83: If an investment project's internal rate of

Q85: Gamma Corporation is considering an investment of

Q88: When evaluating a potential investment, managers should

Q89: discounted cash flow methods consider the time

Q89: When a company is evaluating an investment

Q92: Cash flows used in NPV and IRR

Q95: Which of the following most accurately describes

Q96: The benefit foregone by not choosing an

Q98: Which of the following situations suggests the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents