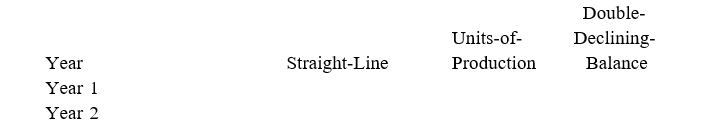

A machine costing $450,000 with a 4-year life and an estimated salvage value of $30,000 is installed by Peters Company on January 1. The company estimates the machine will produce 1,050,000 units of product during its life. It actually produces the following units for the first 2 years: Year 1, 260,000; Year 2, 275,000. Enter the depreciation amounts for years 1 and 2 in the table below for each depreciation method. Show calculation of amounts below the table.

Correct Answer:

Verified

Straight-line:

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q222: Anderson Company sold a piece of equipment

Q223: A company purchased mining property for $1,837,500

Q224: The depreciation method that charges a varying

Q225: _is an estimate of an asset's

Q226: Record the following events and transactions for

Q228: A company purchased mining property for $4,875,000

Q229: On April 1 of the current year,

Q230: _ refers to a plant asset that

Q231: The depreciation method that uses a depreciation

Q232: The insufficient capacity of a company's plant

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents