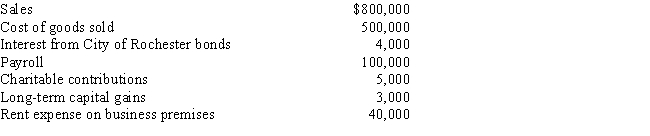

Starling Corporation is a calendar year S corporation. For the current year, Starling had the following transactions:

a.What is Starling Corporation's taxable income?

b.What are the separately stated items?

Correct Answer:

Verified

Q124: Arthur forms Catbird Corporation with the following

Q125: Jack is a 40% partner in the

Q126: Crimson Corporation owns stock in other C

Q127: For 2017, Plover Corporation, a calendar year

Q128: During 2017, Violet had the following capital

Q130: Drab Corporation, a calendar year and cash

Q131: Why were the check-the-box Regulations issued?

Q132: Sophia and William form the Bobwhite Corporation

Q133: Ruby Company, a clothing retailer, donates children's

Q134: Murrelet Corporation is a calendar year taxpayer

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents