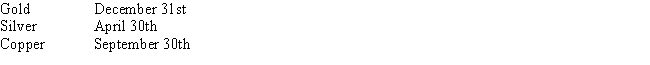

Gold Corporation, Silver Corporation, and Copper Corporation are equal partners in the GSC Partnership. The partners' tax year-ends are as follows:

A) The partnership is free to elect any tax year.

B) The partnership may use any of the 3 year-end dates that its partners use.

C) The partnership must use a September 30th year-end.

D) The partnership must use a April 30th year-end.

E) None of the above.

Correct Answer:

Verified

Q12: A doctor's incorporated medical practice may end

Q17: A retailer must actually receive a claim

Q18: The DEF Partnership had three equal partners

Q19: In 2006, a medical doctor who incorporated

Q20: A CPA practice that is incorporated earns

Q22: A C corporation is required to annualize

Q24: Teal, Inc., used the lower of cost

Q25: The taxpayer does need the IRS's permission

Q26: If an installment sale contract does not

Q36: In regard to choosing a tax year

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents