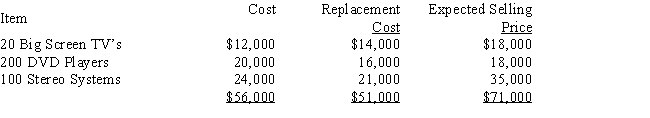

The taxpayer is an appliance dealer and has the following items of inventory on hand at the end of the year:  Under the lower-of-cost-or-market inventory method, the ending inventory value is:

Under the lower-of-cost-or-market inventory method, the ending inventory value is:

A) $71,000.

B) $56,000.

C) $51,000.

D) $49,000.

E) None of the above.

Correct Answer:

Verified

Q73: Under the percentage of completion method, if

Q90: Brown Corporation elected dollar-value LIFO in 2012.

Q91: Ramon sold land in 2017 with a

Q93: Mallard Auto Parts, Inc. has on hand

Q94: Crow Corporation has used the LIFO inventory

Q96: Duck Company has valued its inventories at

Q97: A manufacturer must capitalize the following costs

Q98: The use of the LIFO inventory method

Q99: In 2017 George used the FIFO lower

Q100: Robin Construction Company began a long-term contract

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents