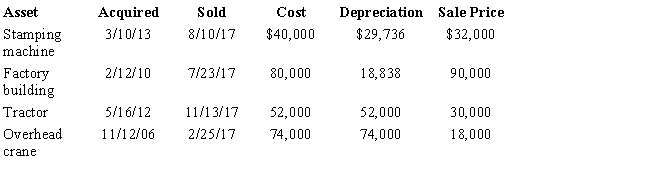

The chart below describes the § 1231 assets sold by the Ecru Company (a sole proprietorship) this year. Compute the gain or loss from each asset disposition and determine the net § 1231 gain treated as long-term capital gain for the year. Assume there is a § 1231 lookback loss of $4,000.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q64: Describe the circumstances in which the maximum

Q65: A business machine purchased April 10, 2016,

Q66: Describe the circumstances in which the potential

Q67: An individual taxpayer has the gains and

Q68: Williams owned an office building (but not

Q69: In 2017 Angela, a single taxpayer with

Q71: Residential real estate was purchased in 2014

Q72: Charmine, a single taxpayer with no dependents,

Q74: The chart below describes the § 1231

Q145: Vanna owned an office building that had

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents