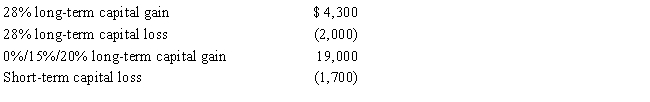

Harold is a head of household, has $27,000 of taxable income in 2017 from non-capital gain or loss sources, and has the following capital gains and losses:

Ignore standard deductions and exemptions. What is Harold's taxable income and the tax on that taxable income?

Ignore standard deductions and exemptions. What is Harold's taxable income and the tax on that taxable income?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q65: In 2013, Aaron purchased a classic car

Q66: Samuel, head of household with two dependents,

Q67: Martha is unmarried with one dependent and

Q69: Phil's father died on January 10, 2017.

Q70: Ranja acquires $200,000 face value corporate bonds

Q71: The chart below details Sheen's 2015, 2016,

Q72: Mike is a self-employed TV technician. He

Q74: Hilda lent $2,000 to a close personal

Q75: Willie is the owner of vacant land

Q141: "Collectibles" held long-term and sold at a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents