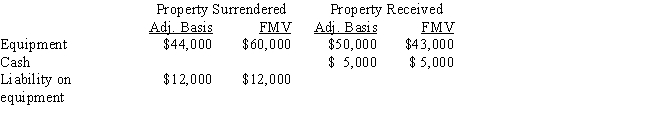

Sammy exchanges equipment used in his business in a like-kind exchange. The property exchanged is as follows:

The other party assumes the liability.

a.What is Sammy's recognized gain or loss?

b.What is Sammy's basis for the assets he received?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q83: During 2017, Zeke and Alice, a married

Q84: During 2017, Ted and Judy, a married

Q85: Evelyn, a calendar year taxpayer, lists her

Q170: Nancy and Tonya exchanged assets. Nancy gave

Q173: On October 1, Paula exchanged an apartment

Q176: Dena owns 500 acres of farm land

Q195: Fran was transferred from Phoenix to Atlanta.

Q197: Ross lives in a house he received

Q198: A factory building owned by Amber, Inc.

Q234: For the following exchanges, indicate which qualify

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents