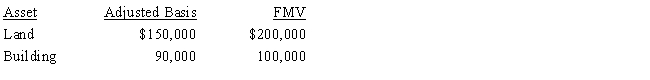

On September 18, 2017, Jerry received land and a building from Ted as a gift. Ted had purchased the land and building on March 5, 2014, and his adjusted basis and the fair market value at the date of the gift were as follows:

Ted paid no gift tax on the transfer to Jerry.

a.Determine Jerry's adjusted basis and holding period for the land and building.

b.Assume instead that the FMV of the land was $89,000 and the FMV of the building was $60,000. Determine Jerry's adjusted basis and holding period for the land and building.

Correct Answer:

Verified

Q104: Annette purchased stock on March 1, 2017,

Q105: Faith inherits an undivided interest in a

Q106: Mitch owns 1,000 shares of Oriole Corporation

Q110: Ed and Cheryl have been married for

Q112: Emma gives her personal use automobile (cost

Q113: Omar has the following stock transactions during

Q182: Ollie owns a personal use car for

Q207: Monica sells a parcel of land to

Q215: Jan purchases taxable bonds with a face

Q217: Melody's adjusted basis for 10,000 shares of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents