Jesse placed equipment that cost $48,000 in service in 2015 (neither § 179 expensing nor bonus depreciation was elected) . On July 1, 2017, Jesse sold the equipment for $22,000.

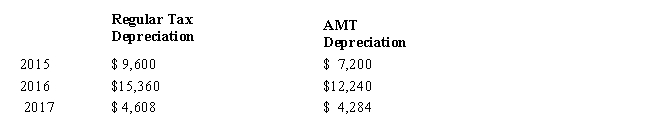

Regular tax and AMT depreciation amounts for the equipment are computed as follows.

What AMT adjustments will be required for the equipment for 2017?

A) $5,844 positive adjustment depreciation; $1,292 positive adjustment equipment sale

B) $324 positive adjustment depreciation; $(5,844) negative adjustment equipment sale

C) $648 positive adjustment depreciation; $(2,276) negative adjustment equipment sale

D) $324 positive adjustment depreciation; $0 adjustment for the equipment sale

Correct Answer:

Verified

Q68: Tamara operates a natural gas sole proprietorship

Q84: Use the following selected data to calculate

Q85: Use the following data to calculate Jolene's

Q86: Which of the following statements is correct?

A)

Q87: Robin, who is a head of household

Q88: Celia and Christian, who are married filing

Q90: Mauve, Inc., records the following gross receipts

Q91: Tad and Audria, who are married filing

Q93: In 2017, Brenda has calculated her regular

Q94: Arlene, who is single, reports taxable income

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents