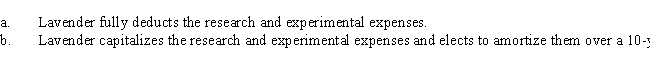

Lavender, Inc., incurs research and experimental expenditures of $210,000 in 2017. Determine the amount of the AMT adjustment for 2017 and for 2018 if for regular income tax purposes, assuming in independent cases that:

Correct Answer:

Verified

Q84: Do AMT adjustments and AMT preferences increase

Q96: What tax rates apply in calculating the

Q100: Sand Corporation, a calendar year C corporation,

Q101: Lilly is single and reports zero taxable

Q102: Abigail, who is single, reported taxable income

Q103: Darin, who is age 30, records itemized

Q104: Why is there a need for a

Q107: In calculating her 2017 taxable income, Rhonda,

Q109: Beige, Inc., records AMTI of $200,000. Calculate

Q110: What is the relationship between taxable income

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents