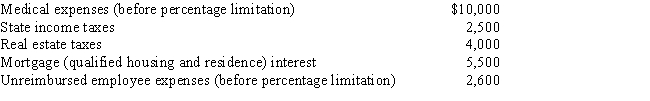

Cindy, who is single and age 48, has no dependents and has adjusted gross income of $50,000 in 2017. Her potential itemized deductions are as follows.

What are Cindy's AMT adjustments for itemized deductions for 2017?

What are Cindy's AMT adjustments for itemized deductions for 2017?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q90: Melinda is in the 35% marginal regular

Q93: What is the relationship between the regular

Q95: How can the positive AMT adjustment for

Q98: If a taxpayer deducts the standard deduction

Q112: Frederick sells equipment whose adjusted basis for

Q113: In May 2013, Swallow, Inc., issues options

Q115: What is the purpose of the AMT

Q116: Crimson, Inc., provides you with the following

Q118: Which of the following statements regarding differences

Q119: Gunter, who is divorced, reports the following

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents