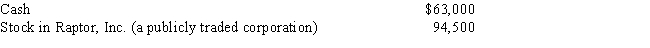

During the current year, Ralph made the following contributions to the University of Oregon (a qualified charitable organization) : Ralph acquired the stock in Raptor, Inc., as an investment fourteen months ago at a cost of $42,000. Ralph's AGI for the year is $189,000. What is Ralph's charitable contribution deduction for the current year?

A) $56,700

B) $63,000

C) $94,500

D) $157,500

E) None of the above

Correct Answer:

Verified

Q86: Samuel, a 36-year-old individual who has been

Q87: Aaron, age 45, had AGI of $40,000

Q89: Ross, who is single, purchased a personal

Q90: Marilyn, age 38, is employed as an

Q91: Georgia had AGI of $100,000 in 2017.

Q93: Paul, a calendar year married taxpayer, files

Q93: In Piatt County, the real property tax

Q94: Charles, who is single and age 61,

Q95: Paul and Patty Black (both are age

Q97: George is single and age 56, has

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents