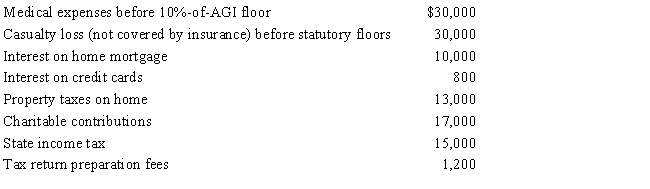

For calendar year 2017, Jon and Betty Hansen (ages 59 and 60) file a joint return reflecting AGI of $280,000. They incur the following expenditures:

What is the amount of itemized deductions the Hansens may claim?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q61: Emily, who lives in Indiana, volunteered to

Q80: Brad, who uses the cash method of

Q82: Brian, a self-employed individual, pays state income

Q82: Helen pays nursing home expenses of $3,000

Q86: During 2017, Kathy, who is self-employed, paid

Q86: Samuel, a 36-year-old individual who has been

Q87: Aaron, age 45, had AGI of $40,000

Q89: Manny, age 57, developed a severe heart

Q89: Ross, who is single, purchased a personal

Q96: Shirley sold her personal residence to Mike

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents