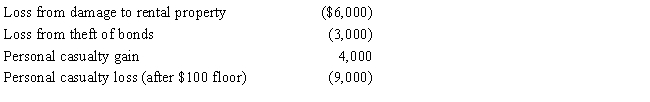

In 2017, Morley, a single taxpayer, had an AGI of $30,000 before considering the following items:  Determine the amount of Morley's itemized deduction from the losses.

Determine the amount of Morley's itemized deduction from the losses.

A) $0

B) $2,900

C) $5,120

D) $5,600

E) None of the above

Correct Answer:

Verified

Q62: Ivory, Inc., has taxable income of $600,000

Q63: On July 20, 2016, Matt (who files

Q64: In 2017, Grant's personal residence was completely

Q65: Jim had a car accident in 2017

Q66: In 2017, Wally had the following insured

Q68: In 2016, Sarah (who files as single)

Q69: Bruce, who is single, had the following

Q70: Alicia was involved in an automobile accident

Q71: Last year, Green Corporation incurred the following

Q72: Norm's car, which he uses 100% for

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents